In 2021, the NFT art sector recorded US$11.1 billion in combined sales, in just one indication of how Web3 has gripped the cultural market. Alongside the rise of the digital medium are also emerging mechanisms inviting both organizations and consumers to interact with NFTs in new and expansive ways. One facet of NFTs that’s lately been gaining traction? Fractionalized NFTs.

Already, the field of fractionalized NFTs (F-NFTs) can claim a swelling market cap that has surpassed $200 million. There is a growing number of platforms offering to fractionalize NFTs or offer F-NFTs, including Particle, Masterworks, and Art Consortium, in addition to blooming collector interest. In ART+TECH’s latest survey, 21 percent of respondents noted that they’ve already purchased an F-NFT, with a third saying they plan to do so in the future. But what even are F-NFTs, and what potential do they hold for the art and cultural space?

What are fractionalized NFTs?

PleasrDAO, which bought the iconic Doge NFT for $4 million, raked in some $200 million when the NFT was fractionalized and sold as 17 billion tokens.

F-NFTs are created when a single NFT is divided into multiple fractions that can be sold as separate tokens. This would allow buyers to own a percentage of a particular NFT, which they can resell or manage. Effectively, F-NFTs encourage inclusion and participation in art ownership (or are marketed as such) by lowering the risk and barriers to digital collecting.

In an early use case, in 2021, PleasrDAO fractionalized the iconic Doge meme into 17 billion F-NFTs, each priced at 0.0000035186 ETH ($0.013). Originally purchased by PleasrDAO for $4 million, the meme raked in some $200 million when sold as F-NFTs.

How are F-NFTs being used by cultural organizations?

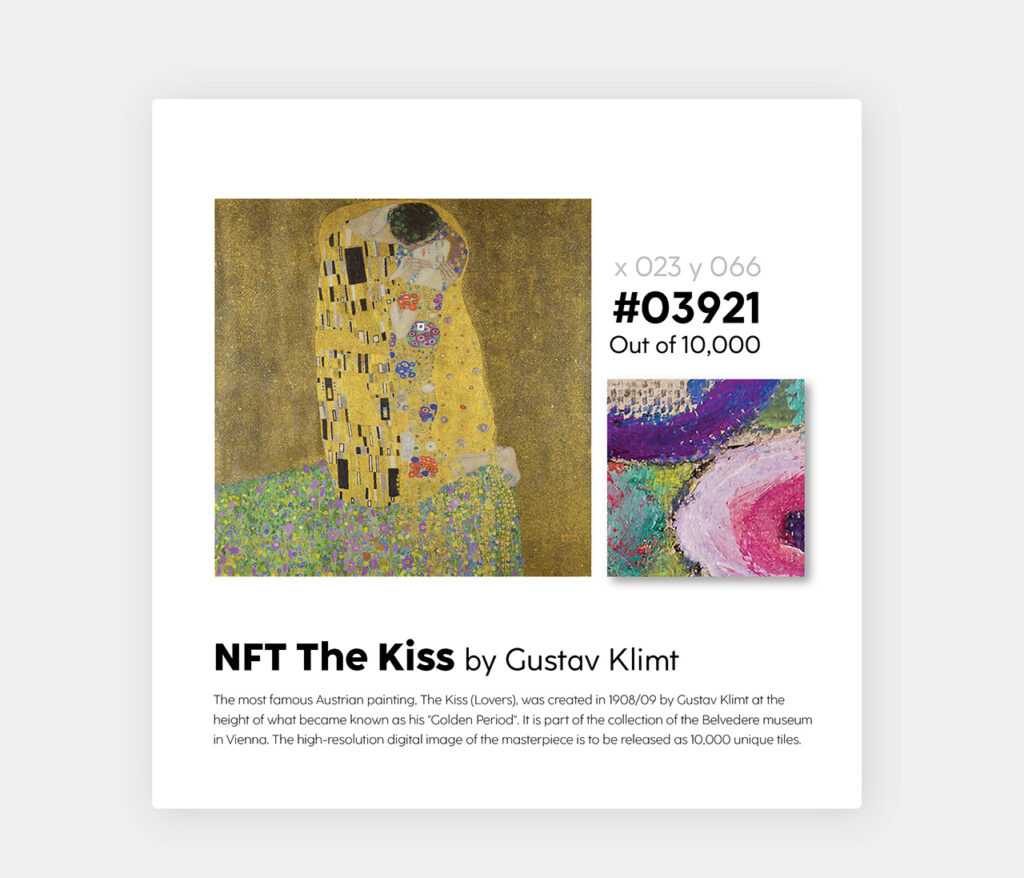

Particle Collection is just one platform that is offering a tokenized artwork as F-NFTs, which come packaged with co-ownership perks. Image: Particle Collection

Chiefly, F-NFTs have been tapped by cultural institutions to offer tokenized art at affordable prices to woo communities and drive revenue.

In one of the highest-profile F-NFT projects by an arts organization, the Belvedere Museum, in a Valentine’s Day-themed campaign, tokenized and fractionalized Gustav Klimt’s “The Kiss” into 10,000 NFTs, selling each of them at €1,850 ($1930.59). Buyers could register as owners of their particular fractions or gift them to their significant others by attaching a dedication of love. With its first F-NFT project, the Belvedere Museum has sold 2,415 fractions and reportedly raised €3.2 million ($4,717,745).

Earlier still, Particle Collection emerged to offer digitized artworks as fractions or particles, as part of its mission to “democratize collecting practices and, ultimately, to redefine what it means to own a work of art.” The platform’s first project centered on Banksy’s “Love Is In The Air,” which was particalized into 10,000 tokens, each priced at $1,500. Each NFT holder enjoys further co-ownership benefits including a digital certificate verifying ownership and a say in where the physical work is to be exhibited.

So how might F-NFTs benefit cultural organizations?

- Accessibility — F-NFTs make art ownership accessible by enabling more people (as opposed to one single buyer) to purchase and own fractions of a digital work. In this, it captures the democratized and decentralized ethos of Web3.

- Revenue — As PleasrDAO and Belvedere Museum have found out, F-NFT projects, quite simply, generate revenue.

- Community — There’s every opportunity to build on a group of F-NFT holders, who collectively own a piece of digitized artwork, into a vibrant community of co-owners and art patrons.

And what are some pitfalls?

- Co-ownership disputes — Friction among fractional holders of a single NFT might arise, whether due to murky shared ownership terms or differences in how various owners may choose to resell or manage their fraction.

- A volatile market — Let’s face it: the crypto and NFT markets remain volatile, which means the value of a F-NFT will wax and wane alongside market forces. The Belvedere Museum’s Klimt F-NFTs, for example, recently tanked in value in the wake of the crypto bear market.

What are some key considerations before embarking on a F-NFT project?

Earlier in 2022, the Belvedere Museum sold 2,415 of 10,000 available F-NFTs of Gustav Klimt’s “The Kiss,” raising more than $4 million in revenue. Image: artèQ

Creating value — An art F-NFT can only be of significance when it represents part of a larger artwork that holds value or represents cultural cache. A careful market analysis of the tokenized work should be undertaken to avoid stagnant sales.

Building utility — Tokenizing, fractionalizing, and selling an artwork in its holdings can raise funds for a cultural institution, but how will said cultural institution further engage with its F-NFT holders who in turn represent donors or patrons? By integrating incentives such as private viewings, exclusive merch drops, or a say in gallery operations into their F-NFTs, cultural organizations ensure their tokens retain value, while making the best out of a community of blockchain-based consumers.

Activating community — Community matters in a decentralized medium; and selling F-NFTs effectively creates a pool of co-owners that cultural organizations can build upon. How will an institution activate its F-NFT holders to capture their continued interest and participation? And how can museums use F-NFT offers to repurpose art patronage for Web3?

Allocating resources — All of the above is to say that cultural organizations should view F-NFT sales through the lens of a longer-term roadmap, creating continued value for their F-NFT holders and establishing a community that’s continuously invested in the project. That means ensuring there are resources at hand (whether social media expertise, community management, or blockchain know-how) to sustain an ongoing plan, as opposed to a one-and-done NFT sale, and to lock in a solid return on investment.