Jing Daily has released Chinese Cultural Consumers: The Future of Luxury, a report that offers a high-level overview of China’s new class of consumers, detailing their spending habits, tastes, and cultural appetites.

The Chinese Cultural Consumer (CCC) is roughly made up of highly educated millennial or Gen Z individuals who typically are very digitally engaged. While exposed to a globalized environment, they show a deeper appreciation for Chinese culture and aesthetics than previous generations. And perhaps most importantly, they spend money. According to the report, Gen Z and millennial shoppers spend an average of 42 percent of their paychecks on luxury.

Crucially, CCCs are also increasing their influence in the arts sector. “The new generation of Chinese Cultural Consumers are very savvy and have an enormous appetite for knowledge of the arts, not just coming from China but from the rest of the world as well, and that has only intensified on the digital front as restrictions on international travel have persisted,” says Sky Canaves, Content Director at Jing Daily and the report’s editor. “They are looking for creative online experiences as well as really appreciating the in-person events that they can attend.”

For arts and cultural organizations hoping to engage CCCs, here are four essential pointers to note.

Art as lifestyle

Perfect Diary x The Metropolitan Museum of Art. Image: Perfect Diary on WeChat

Not only did China become the world’s largest art market in 2011, surpassing Europe and the US, but the arts in general drive a significant portion of Chinese cultural consumption. It explains the market’s penchant for art collaborations from Perfect Diary’s partnerships with the Met and British Museum to Sotheby’s team-up with C-pop star Jay Chou, which, the report notes, “integrated entertainment and art to reimagine the possibilities for fine art auctions.”

Art collecting and collectibles further contribute to the CCCs’ aspiration for a lifestyle that reflects their cultural sophistication. While art toy companies such as Pop Mart, 52TOYS, IP Station, and Block 12 have grown in popularity, so has the demand for rare or artist-made collectibles. “Young people love the KAWS figures, and the Pikachu figures made by Daniel Arsham,” says Michael Xufu Huang, Co-Founder of X Museum. “I think that’s a good start because that could be a jumping-off point for them to take their interests into fine art.”

Guochao: China loves local

Hanfu apparel label Thirteen Yu has secured investment from video streaming platform Bilibili and collectible toy brand Pop Mart. Credit: Thirteen Yu

Though CCCs may have grown up in a globalized world, according to Jing Daily columnist Daniel Langer, “they are more patriotic than any generation before and like to support homegrown businesses.” Alongside that patriotism has been a resurgence of interest in Chinese heritage, particularly in in Chinese antiquities and history, whether it’s Han clothing (hanfu) or classical paintings (guohua).

As Arnold Ma, the founder of digital marketing agency Qumin explains, “[Hanfu] was seen as a really traditional subculture a few years ago, yet nowadays it’s contemporary because a lot of young people and brands have jumped onto it.”

Wenchuang: The demand for culture

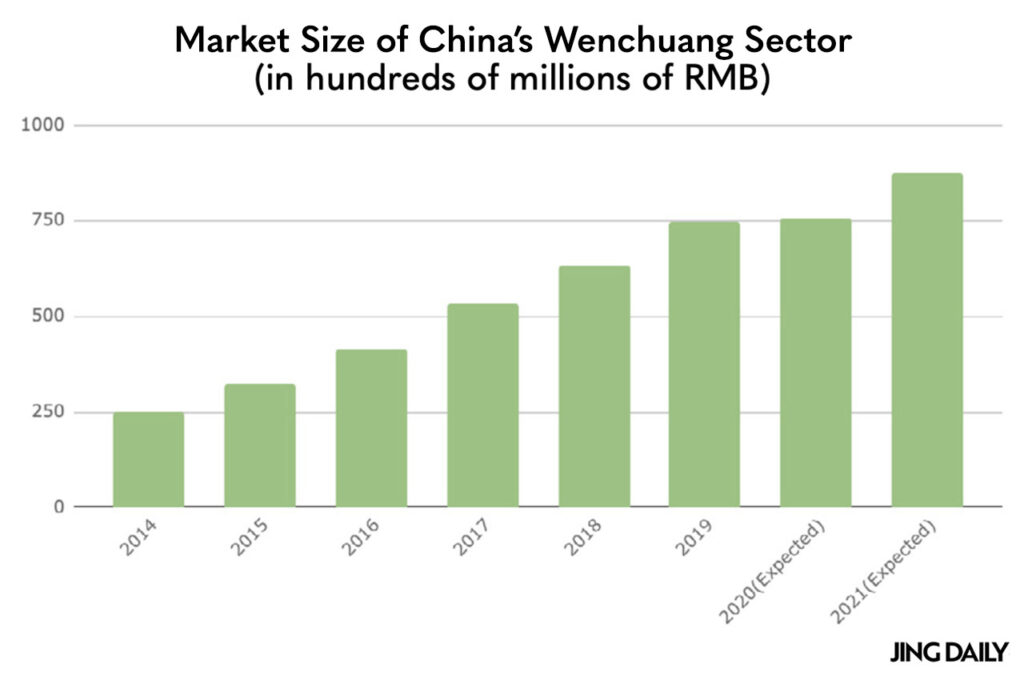

Since its emergence in the early 2010s, the wenchuang space has grown such that the Chinese government has recognized the economic significance of the sector. Image: Jing Daily

The appeal of domestic culture and heritage has further seen museums jumping on board with products based on their cultural IP (wenchuang). For instance, Beijing’s Palace Museum (the Forbidden City) has leveraged its IP in merchandise such as phone covers, art toys, food, cosmetics, TV shows, and VR experiences. Gansu’s Dunhuang MoGao Caves and related cultural institutions (including Dunhuang Research Academy and Dunhuang Museum) have similarly launched beauty, fashion, and game content collaborations (i.e. in-game “skins” for characters, background music for characters).

Especially over the past year’s lockdowns, wenchuang and its associated online activities have helped museums “bring in much-needed revenue,” according to the report.

Where CCCs live, shop, and socialize

On International Museum Day, MFA Boston partnered with Kuaishou to host a four-hour e-commerce livestream to promote a range of Monet merchandise including scented candles and graphic T-shirts. Image: Kuaishou

While platforms like Instagram are popular with all global communities, Chinese social media applications like Xiaohongshu, Bilibili, and WeChat, are the way into the lives (and wallets) of young cultural consumers. Platforms like Tencent’s WeChat, in particular, offer users a holistic ecosystem, seamlessly melding a host of services and functions from a search engine to e-commerce to short-video, and enabling brands and museums to build what the report calls “an extremely accommodating customer journey.” Ma adds of CCC habits, “People have always been happy to buy things mobile-first.”

For brands or cultural organizations to stand out among the glut of content on these platforms, the report recommends avoiding mundane marketing for video-based content. Notably, e-commerce livestreaming has seen a burgeoning audience — from 265 million in March 2020 to an approximate 388 million in December 2020 — and has already been leveraged by cultural institutions like the Museum of Fine Art Boston. “[CCCs] embrace physical experiences that are digitally enhanced,” as the report sums up, “and look to brands that can meet their familiarity with social commerce along with an understanding of China’s heritage.”

Purchase Chinese Cultural Consumers: The Future of Luxury here.