In 2010, Wang Ning was plotting a toy empire from the confines of his university dormitory. Ten years on, his entrepreneurial venture, Pop Mart, is maturing in a manner fitting for a brand that crafts playthings not for children, but white-collar workers.

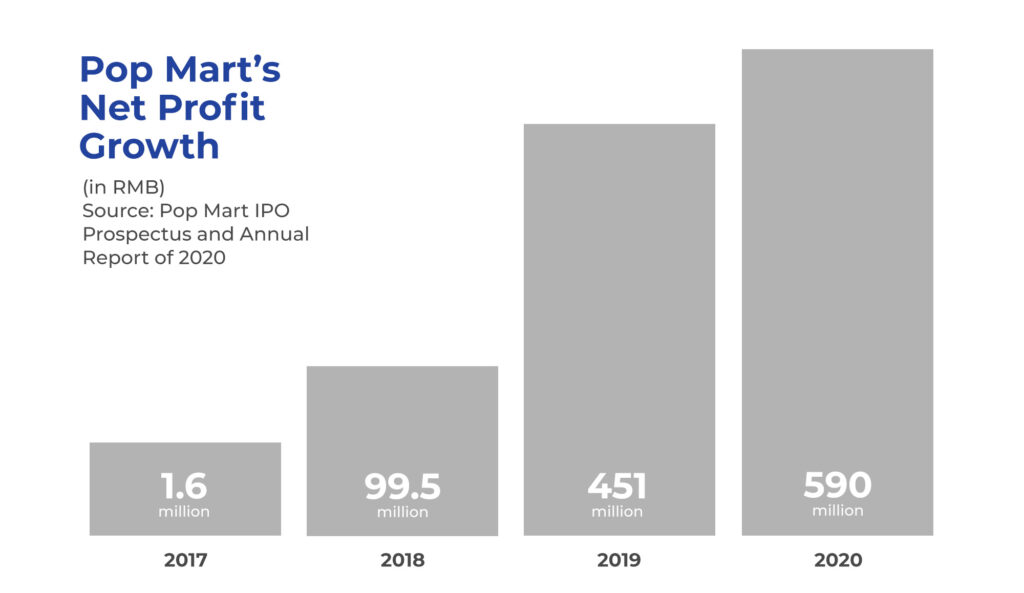

Pop Mart’s 50 percent revenue growth over 2019 continued despite pandemic disruptions: it raised $674 million through an initial public offering in Hong Kong, and welcomed more than 100,000 people to a pop toy expo it organized in Shanghai.

For the uninitiated, Pop Mart specializes in collectible vinyl figurines created from 85 intellectual properties (IPs) it owns or operates. Two core strategies have made it China’s largest and fastest-growing pop toy company: blind boxes, a packaging practice that obscures a product’s identity, and its 1,300-odd roboshops, toy dispensers styled off Japanese gashapon vending machines.

In April, the Beijing-based company released its annual report, one offering clarity on Pop Mart’s strong 2020 and potential areas of growth in the coming years.

Popping off(line)

Pop Mart’s explosive growth has been fueled by its growing physical footprint in China and a smart e-commerce push.

Pop Mart sold more than 50 million toys last year, which led to $90 million in net profit. Behind these numbers is an expanding offline strategy which drove a 35 percent increase in sales through rolling out 76 new stores (taking the total to 187) and 526 roboshops.

Its growing presence across Chinese shopping hotspots is complemented by a nimble e-commerce strategy (online sales grew 77 percent year-on-year), a point boldly proclaimed during November’s Singles Day shopping bonanza in which Pop Mart has been Tmall’s leading toy retailer for the past two years. In 2020, it reached $21.7 million in sales, making it the first toy company to break the 100 million RMB mark.

Growing the supporting cast

Following the success of its flagship figurine Molly, Pop Mart’s range of exclusive licensed IPs has grown to number 25 as of June 2020. Image: Pop Mart IPO Prospectus

Until 2020, Pop Mart’s explosive growth was driven by the frenzy surrounding its signature IP, Molly, a blond character with oceanic eyes and a washed over gaze. The character, which Wang Ning proudly proclaims to have no backstory, is mentioned 92 times in the IPO prospectus and in 2017, accounted for 89 percent of Pop Mart’s revenue from brand products.

That unhealthy reliance has gradually been whittled away through building out a diverse cast of figurines for which Pop Mart holds exclusive IP. This year, Molly’s sales grew (a new line released in summer 2020 generated $15.2 million), but her overall share of revenue stood at 14.2 percent with Dimoo, a boy with a penchant for animal getups, accounting for 12.5 percent; Pucky, an “adorable” baby with a versatile wardrobe, making up 11.9 percent; and the Monsters, an eclectic cast of, well, monsters, reaching 8.1 percent. The remainder of sales were spread across Pop Mart’s other IPs.

Making members not consumers

Pop Mart’s prospectus pledged to use 30 percent of IPO proceeds to partly finance an expansion into international markets. The brand may boast a market share of 8.5 percent in China, but globally, it’s only beginning to gain traction and faces stiff competition. At present, Pop Mart sells in more than 20 countries — new stores recently opened in South Korea and Canada — with international sales increasing 176 percent year-on-year in 2020.

In China, growing membership has been key to creating brand loyalty and driving sales; the group makes up nearly 90 percent of sales and numbered 7.4 million by the end of 2020. Pop Mart will be hoping its strategy will be applicable well beyond China’s borders.