Kate Vass remembers a time about four years ago, when she encountered an online community that was modest yet inviting. “It was humble, it was friendly,” she tells Jing Culture & Commerce. “Everybody was very supportive towards each other.” It was the nascent crypto art scene, made up of emerging artists, curators, and blockchain platforms, and glued together by a shared ambition to democratize the art industry. Effectively, these early crypto players would lay the foundations for an alternative, creative economy unbound by gatekeeping and largely untouched by the media spotlight.

While the crypto art space today remains powered by the same spirit and enterprise, the past few months have completely transformed the stakes. A rush for non-fungible tokens (NFTs) — intensified by celebrity involvement, pandemic-fueled speculation, and one blockbuster Christie’s sale — has cast the crypto marketplace in sharp relief, with buyers and investors piling on and driving up the demand and market value of digital collectibles. For Vass, an early crypto adopter, it’s an equally encouraging and exasperating circumstance. “Watching people cash out as much as possible without really thinking how it may impact the whole industry,” she says, “it’s very frustrating.”

As part of his 2018 project IAMA Coin, Kevin Abosch produced 100 physical works — foil pouches containing his blood and printed with a blockchain address — and 10 million virtual tokens. Image: Kate Vass Galerie

And the gallerist knows what she’s talking about. In 2017, she launched Kate Vass Galerie in Zürich, and swiftly found a niche at the intersection of art and cutting-edge technology where she could “build up something valuable that reflects our times.” 2018’s Perfect & Priceless was one such endeavor; billed as Switzerland’s first blockchain art exhibition, it arrayed the works of such pioneering digital creators as Rob Myers, Cryptopunks, and Terra 0, and showcased Kevin Abosch and Ai Weiwei’s collaboration, “PRICELESS,” which interrogated the value of intangible art.

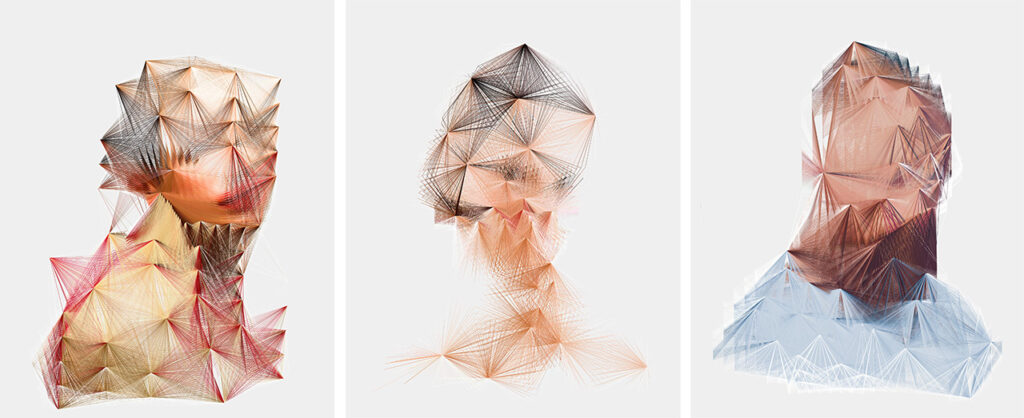

Other presentations exploring artificial intelligence and generative art followed, before Vass decided, in 2019, to enter the NFT fray. The occasion: a solo showing of Norwegian artist Espen Kluge’s generative portraits, during which some works were sold as physical limited edition prints, and five were tokenized on SuperRare and OpenSea. While traditional art collectors purchased the physical pieces at the exhibition, “different types of collectors who were already familiar with crypto,” says Vass, went on to acquire the NFTs on the blockchain platforms after the opening.

According to her, the challenge of entering the NFT market then lay not in tech adoption barriers — platforms like OpenSea are exceedingly user-friendly — but in shifting the mindsets of those who buy and collect. “I’m always trying to challenge the collector,” she says, adding that she’s emphasized tying physical assets to a digital footprint. “I support the idea that both are important,” she says. “Both should come as a bundle, so you can be more flexible as a collector, should you wish to exhibit the work in a different way.”

Espen Kluge’s generative works were exhibited in 2019 at the gallery — five portraits of which were sold as NFTs on OpenSea and SuperRare. Image: Kate Vass Galerie

If such advice was friendly pre-pandemic, it’s practically essential now as art businesses rush to rally around digital in a bid to reach socially distant buyers. NFTs do open a new and necessary revenue stream for cash-strapped organizations, though Vass warns of diving in without first considering the calibre of art on offer, the environmental cost, and the impact on the existing crypto economy. “It should make sense for the artists and the community. If it doesn’t make sense, don’t do it,” she says. But for galleries serious about NFTs, these digital assets can provide significant support, as their existence on the blockchain alleviates storage, secures provenance, and facilitates transactions.

Last year, Vass’ gallery embarked on a new phase of its NFT venture: occupying virtual land. Like any other NFT, these decentralized lands or digital real estate can be purchased, sold, or leased, and on which users can develop a virtual reality of their own. In virtual worlds like Cryptovoxels and Decentraland, landowners have unveiled 3D creations, monetized games, and yes, showcased art. For players of world-building games like Animal Crossing or Occupy White Walls, none of this should sound unfamiliar. In May 2020, Kate Vass Galerie’s plot in Somnium Space hosted a solo Kluge exhibition, offering a rich digital counterpart to match the artist’s 2019 physical show.

Vass is effusive about the opportunity. Somnium Space, she says, is “a beautiful platform. You have so many different features and you really do feel like you are on Mars. It’s a completely different experience.” Yet, because partaking in these worlds requires the use of virtual reality headsets, she concedes the barriers to participation will be tougher to overcome; plus, post-pandemic, “people will like to be physically present in physical spaces.” Then again, as mainstream attention swivels ever more heatedly onto NFTs, the virtual land community might just be due for some new visitors. And Vass, once again, is already there.